Are we really at "the end of telecoms history?"

What happens to the telecoms industry if mobile networks reach overcapacity and data traffic starts to fall? We might already be in that situation. Has cratering data traffic growth brought us to "the end of telecoms history?"

In 1989, Francis Fukuyama declared that we were at The End of History, in an essay of the same name which argued that liberal democracy would win out as the final model for societal governance. Months after its publication, the Berlin Wall fell, supposedly ushering in the start of a unipolar world.

Now, we’re reaching a similar juncture in telecoms history, according to William Webb, a former Ofcom executive and consultant, in his recent book, aptly titled The End of Telecoms History.

This dramatic title is matched by its thesis: that we have all the connectivity we need, but supply is still growing faster than demand, and in the coming years, the industry will be facing zero growth in data traffic:

Those who are well connected, with good home broadband and good mobile coverage – even if it is only 4G – have all the connectivity that they need. We no longer need to strive for faster networks, for more fibre or for the next generation of mobile technology. The journey that started with Morse and Marconi has come to an end.

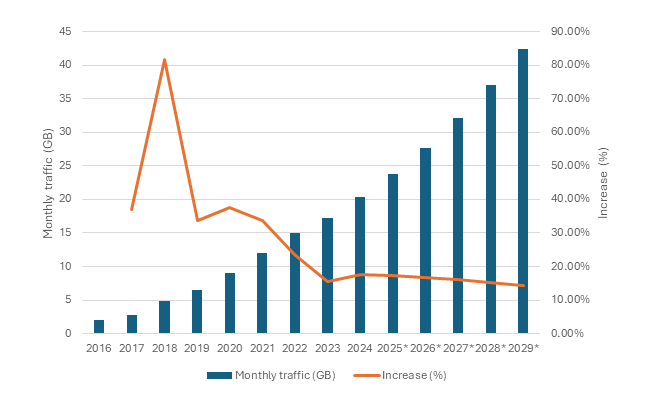

Does the evidence match this bold claim? While a cursory glance at any chart of mobile data traffic shows a reassuring year-on-year rise, overlaying the rate of growth shows that we have entered a period of gradual decline:

Mobile data traffic per smartphone worldwide, 2016-29

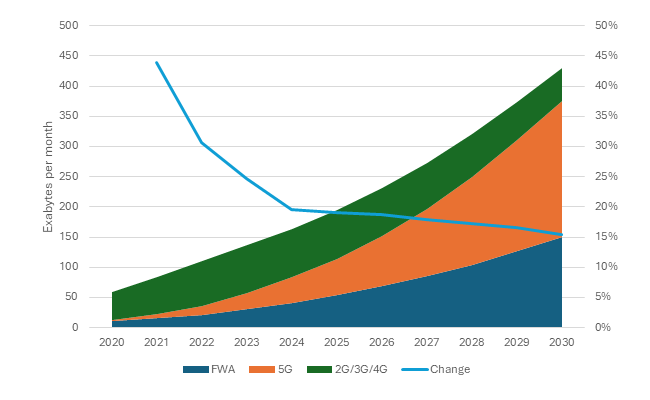

Even more optimistic projections, such as the below from Ericsson, can’t conceal the slowing increase, despite the anticipated uptick in 5G traffic:

The End of Telecoms History goes onto argue that the industry soon faces a 5% per year decline in growth rates for mobile data. Ofcom's Telecommunications Market Update for Q3’2024 had mobile data up 7.7% year on year. In contrast, in Q3 2020, data usage was up by 24.6% year-on-year.

For Webb, there are three reasons for this slowdown:

Demand for data is slowing

It’s a given that most people – certainly those who want one – now own a smartphone.

However, data usage could plateau very soon due to one fact; video makes up the overwhelming majority of traffic, and despite the growing prevalence of second screening, there’s only so much video we can watch.

Nevertheless, by 2027, video is still expected to make up the lion's share of mobile data traffic:

But incremental growth is primarily down to people using their phones to watch more of the same content they’d otherwise be watching on television; 72% of people admit to second screening, using their TV as background noise.

According to an experiment conducted by Warner Bros., most consumers can’t tell the difference between 4K and 8K even on an 88-inch OLED television, so it’s unlikely that higher definition streaming on mobile will be much of a growth area.

Network efficiency is increasing

The data-carrying capacity of today’s networks is growing as a result of better network planning. This should be good news, but combined with continued build-out of networks, this has created what Analysys Mason has dubbed a “crisis of overproduction in bandwidth.”

Collaboration between operators and platforms, such as Vodafone and Meta’s video‑optimisation trials in Europe, can produce “low double‑digit” drops in data usage without affecting user experience.

Operators are also increasingly looking to consolidation, squeezing more connectivity out of existing infrastructure; Virgin Media O2 (VMO2) and Vodafone recently announced a significant spectrum transfer agreement that will see VMO2 acquire 78.8 MHz of Vodafone’s spectrum, enhancing network performance and coverage without the need for additional infrastructure.

But these gains in efficiency might be for nothing if all customers want is consistent service, as the authors of Understanding the metrics of Internet broadband access: How much is enough? argue:

Adding excess bandwidth may actually help to some extent (by reducing the probability that a congestion event will occur). Buying more bandwidth is the only remedy available to users today if there is a problem with their service… More speed may be a poor (and costly) remedy, but it is the only option. We think that encouraging a concerted effort by ISPs (and others) to deal with issues of latency and jitter might allow users to be content with a slower service tier.

New connectivity technology driving the fall in data

Improvements in networks are yielding growth in mobile data capacity.

So far, AI has not driven much of a rise because LLMs’ outputs are largely text-based. As Ericsson’s report notes, GenAI represents only 0.06% of the total data traffic. However, AI use exhibits a higher uplink distribution, with 74% downlink and 26% uplink traffic.

LLMs are only one part of the GenAI tapestry now though, with emerging video, audio, and image generating models being much more data-intensive. Even still, Gartner predicts that it won’t be until 2027 that these multimodal AIs will reach 40% market share.

AI could encode or decode content locally (e.g. sending a text description of an image to be rendered on-device, rather than sending an image outright), driving significant reductions in traffic to devices and offloading to data centres, where traffic is growing massively, but, crucially, not over mobile networks.

AI-driven compression like Nvidia’s Deep Learning Super Sampling (DLSS) could allow the server GPU to render frames at a lower resolution and then upscale them to appear high-quality:

In short, data traffic is slowing, and could reach as low as single-digit growth per year, while network efficiency gains are yielding greater increases. Slowing demand in mature markets is the primary driver behind flat or falling data usage, while efficiency gains reduce network consumption per user and new connectivity innovations add further downward pressure.

But just as political history didn’t really end in 1989, predictions of telecoms’ end may prove misguided. Already this year, private 5G, AI-driven networks, satellite connectivity, and the convergence of telecoms with cloud have ushered in new industry paradigms.

Declaring the end for operators might be premature. Telcos still have valuable assets in the form of significant customer bases and reliable infrastructure. Believing they are now just utility providers might discourage investment in innovation, creating a self-fulfilling prophecy.

The idea that the industry has no future beyond cost-cutting and consolidation ignores the potential for a new vision, where telcos become digital enablers, allowing them to plough their capex into critical infrastructure for new and emerging services such as smart cities, industrial automation or autonomous vehicles.

The challenge is strategic reinvention. Innovation and investment should be shifted to gaps in coverage and cost reduction, rather than capacity. To combat decline, telcos must pivot in several ways:

- Leverage infrastructure for new models

Shared infrastructure, network slicing and private 5G networks can support tailored B2B services. Telcos can monetise their networks in smarter ways, making targeted improvements in areas that will deliver added value. - Radical simplification and digitalisation

Operational agility, driven by AI, automation and digital customer journeys, can reduce costs and enhance competitiveness. - Move up the value chain

Instead of being mere connectivity providers, telcos can offer integrated digital services, including cloud, cybersecurity, IoT platforms and edge computing, especially in enterprise and industrial contexts.

While the telecoms industry may have exited a period of high-growth and innovation, declaring its history as over underestimates the potential for reinvention.

Telcos must move beyond incremental improvements and start acting more like technology companies, or risk becoming irrelevant.